1C:ERP Budgeting Subsystem

This page describes the Budgeting subsystem in 1C:ERP, a comprehensive tool for enterprise financial planning, modeling, and monitoring. It covers key features like flexible budget forms, variance analysis, scenario comparisons, and integration with operational data for effective strategic and operational management.

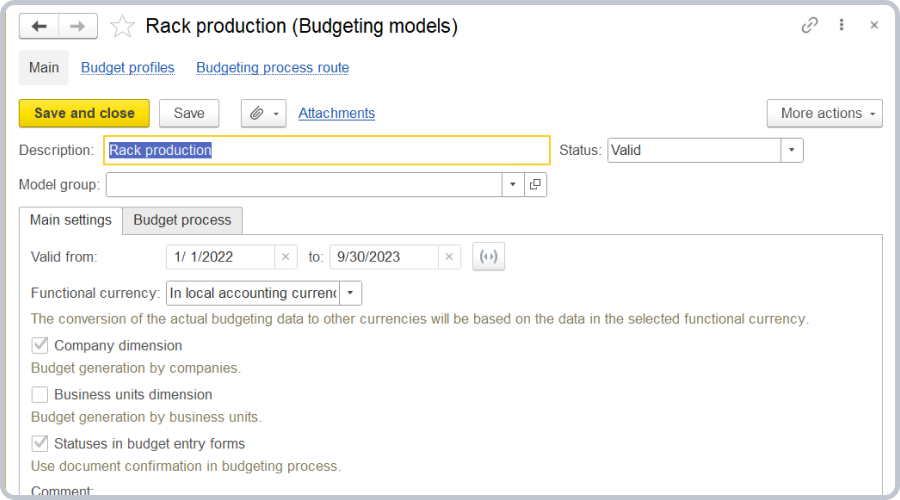

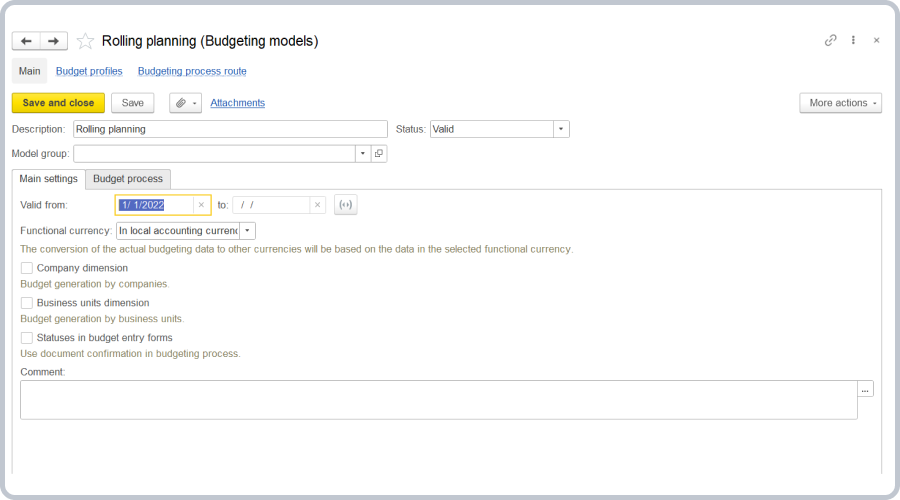

Shelving production (budgeting models)

Payment planning by sales forecasts and purchase plans. The integration capabilities of budgeting allow business models to incorporate data from various sources (such as sales forecasts, purchase plans, and production plans). The system supports automatic population of such dimensions as partners, counterparties, contracts, and cash flow items based on planning documents related to the company's trade and procurement activities. What's more, you can plan payments for the selected budget flow item, as well as separate planning of prepayments and payments after shipment.

You can control cash outflow for any custom period (day, week, month, quarter, half-year, and year) and by any dimensions available in the "Payment request" document (for example, cash flow items, partners, business units, and so on).

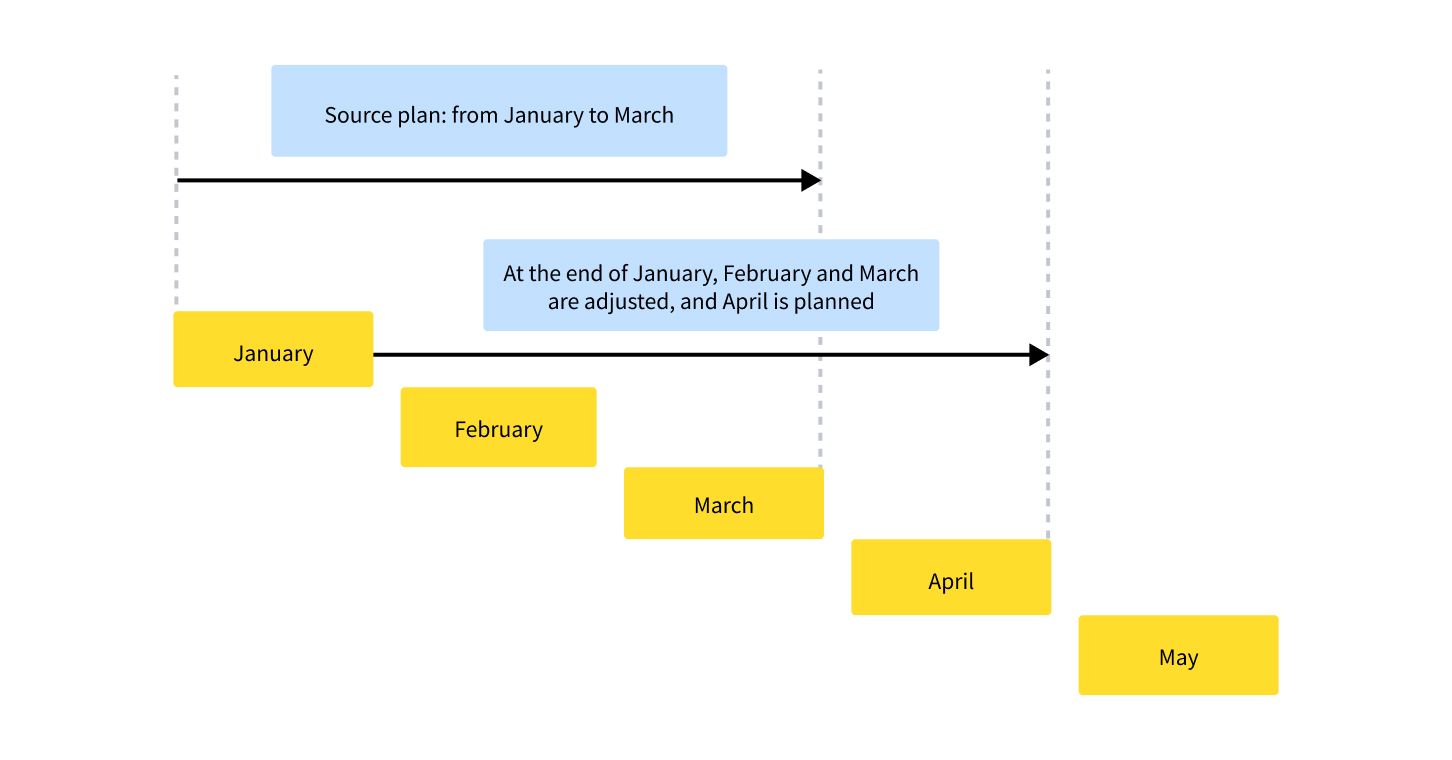

Rolling planning methodology / Setting up rolling planning in 1C:ERP

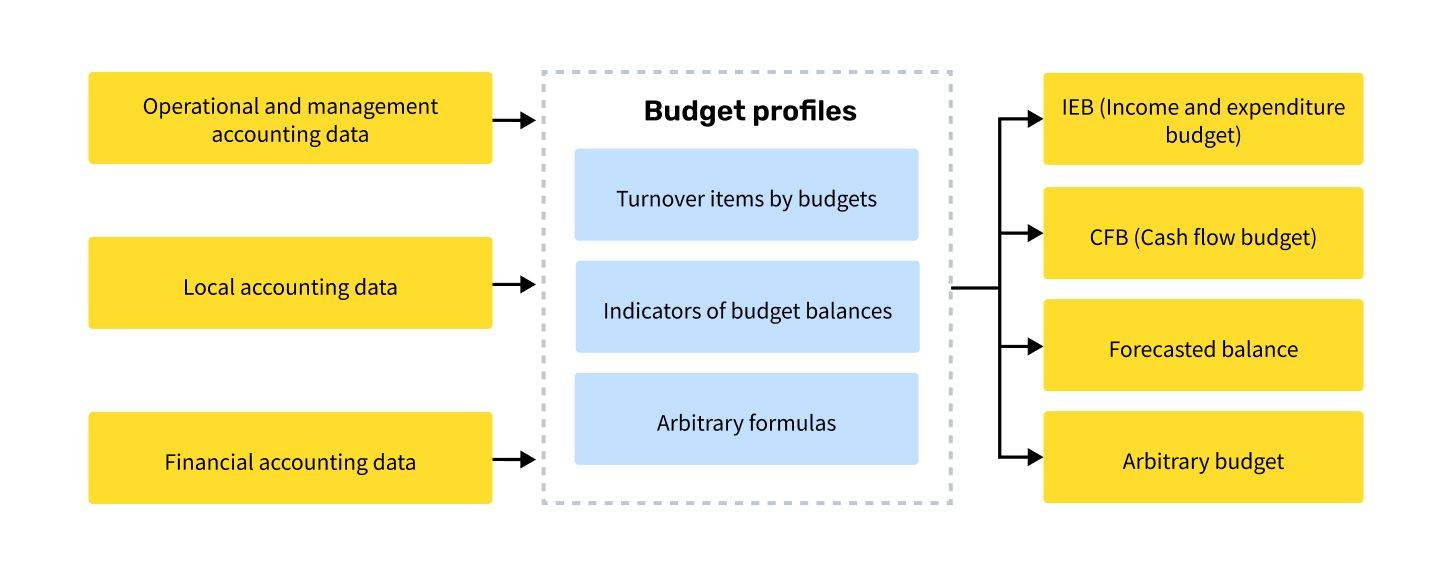

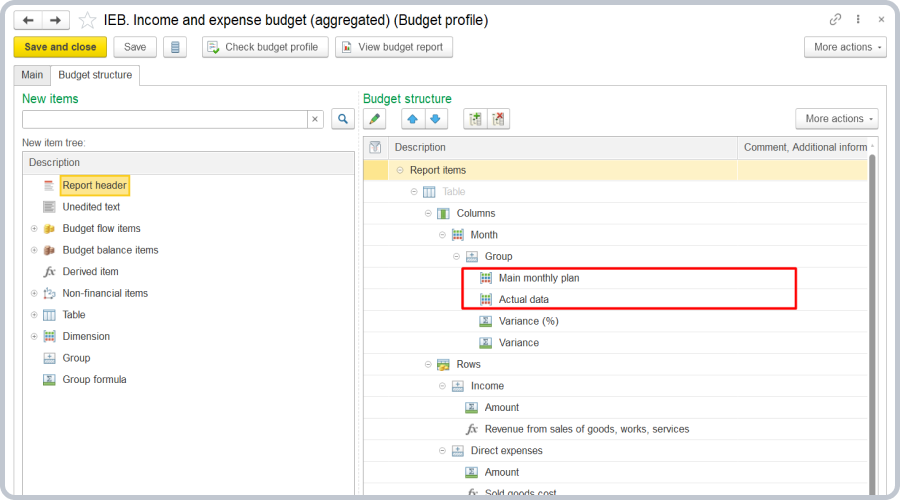

IEB (considering external factors) (Budget profile)

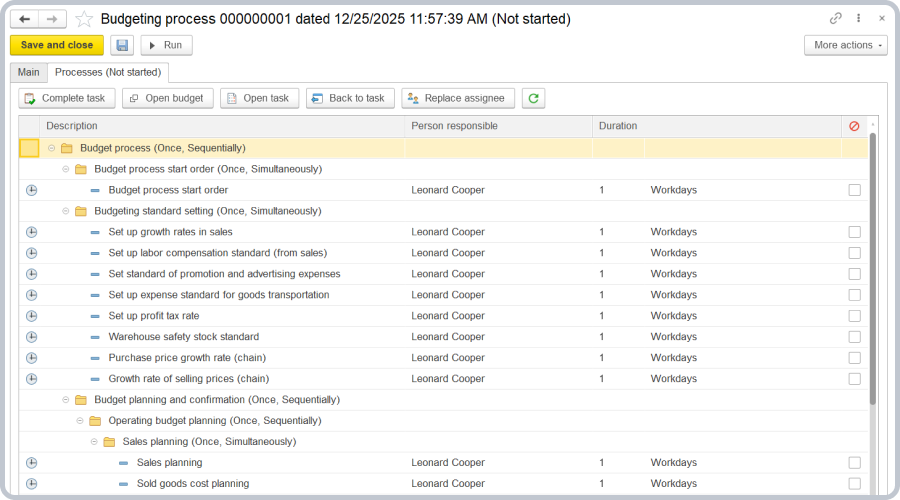

Budgeting process

The budgeting process in the system involves presenting budgeting regulations as budget process steps: entering planned data, calculating plans, monitoring plan execution, and conducting variance analysis.

The system ensures responsibility of the assigned employees for task completion, allowing tasks to be sent to assignees by email and execution progress to be tracked.

Request Demo

Apply for a free personalized product demo and see the value of

1C:ERP yourself.