1C:ERP Expense management & Cost calculation Subsystem

Modern manufacturing companies face the need to manage costs effectively and calculate product costs accurately. Addressing these tasks directly impacts a company's competitiveness, profitability, and market stability. The 1C:ERP software provides powerful tools for managing costs and calculating production costs, making it an indispensable tool for production managers and financial directors.

Why Use the Expense management & Cost calculation?

In the system, you can register and allocate expenses that generate

Enterprise expenses are divided into the following groups with different allocation procedures

Product Cost Allocation

Product costs are allocated by volume (quantitative) indicators in physical units. Physical units allow tracking receipt lot records for product costs, which is necessary for separate cost accounting and "complex" VAT accounting.

Standard expenses with variances recorded in production documents are included in the cost automatically.

Additional allocation is performed for accounting variances (in the system) and actual (obtained outside the system, for example, during physical inventory count) balances identified at the end of the accounting period.

There are several ways to allocate product costs: custom rule, to expense items, by lot, and by release. You can use the options together, just make sure the entire volume of variances is allocated. You can allocate product costs in accordance with the selected expense allocation rule.

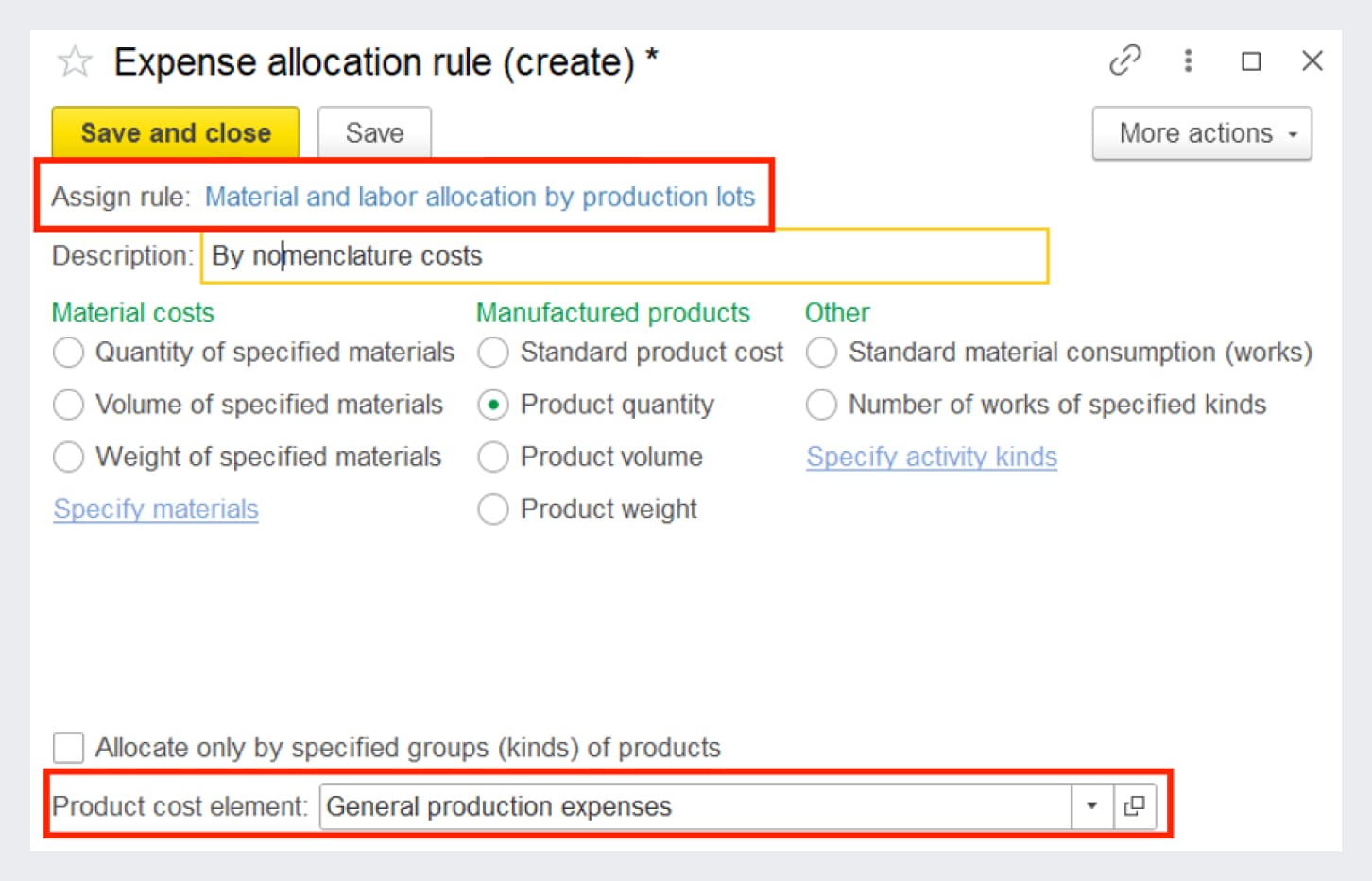

To allocate product costs according to the rules, select a cost allocation base: quantity of specified materials, weight of specified materials, standard product cost, and so on.

Creating expense allocation rules

To allocate product costs, use the "Material and labor allocation" document, which allows you to check the allocation base generated according to the selected rule.

Expense Allocation

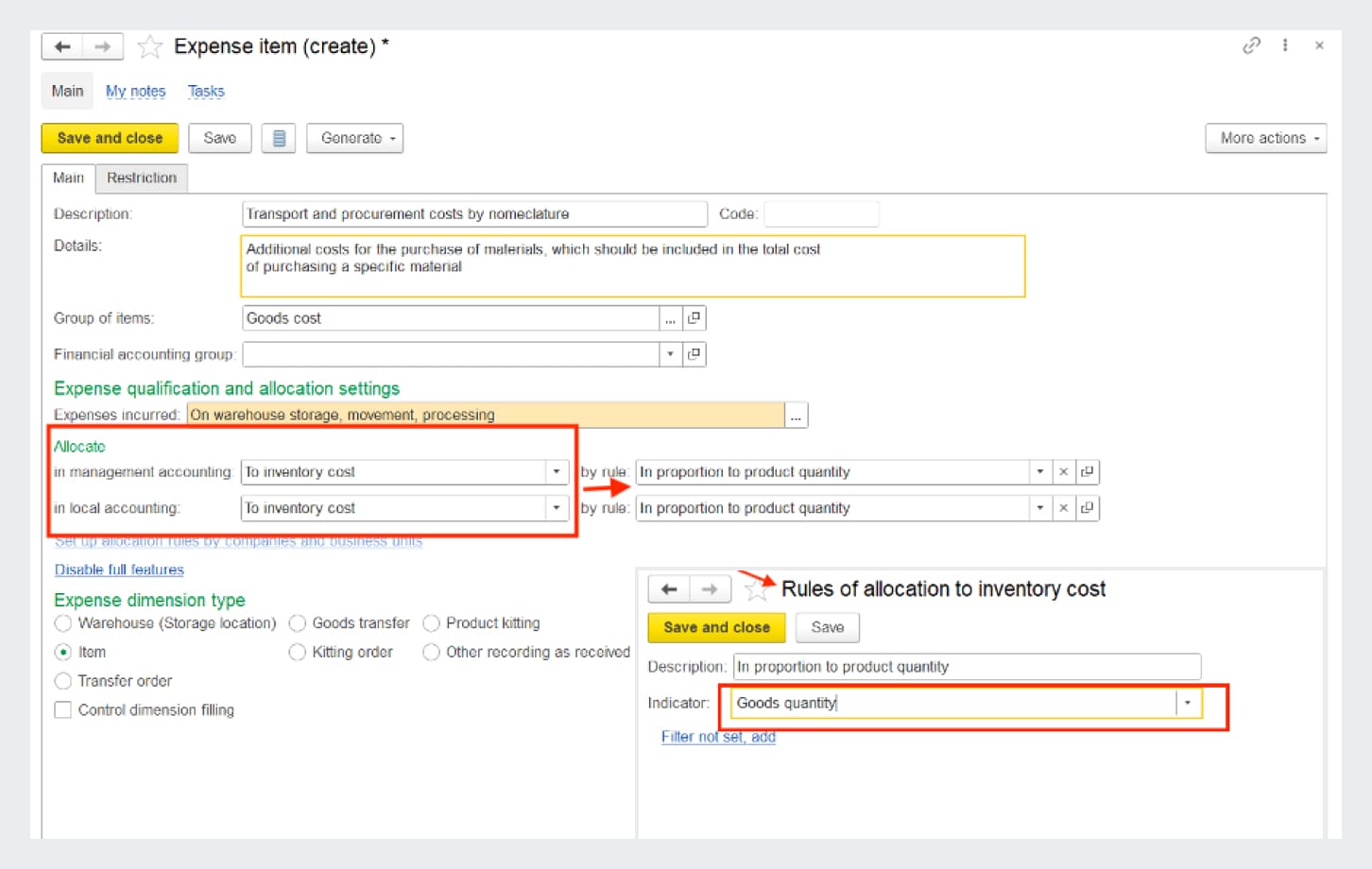

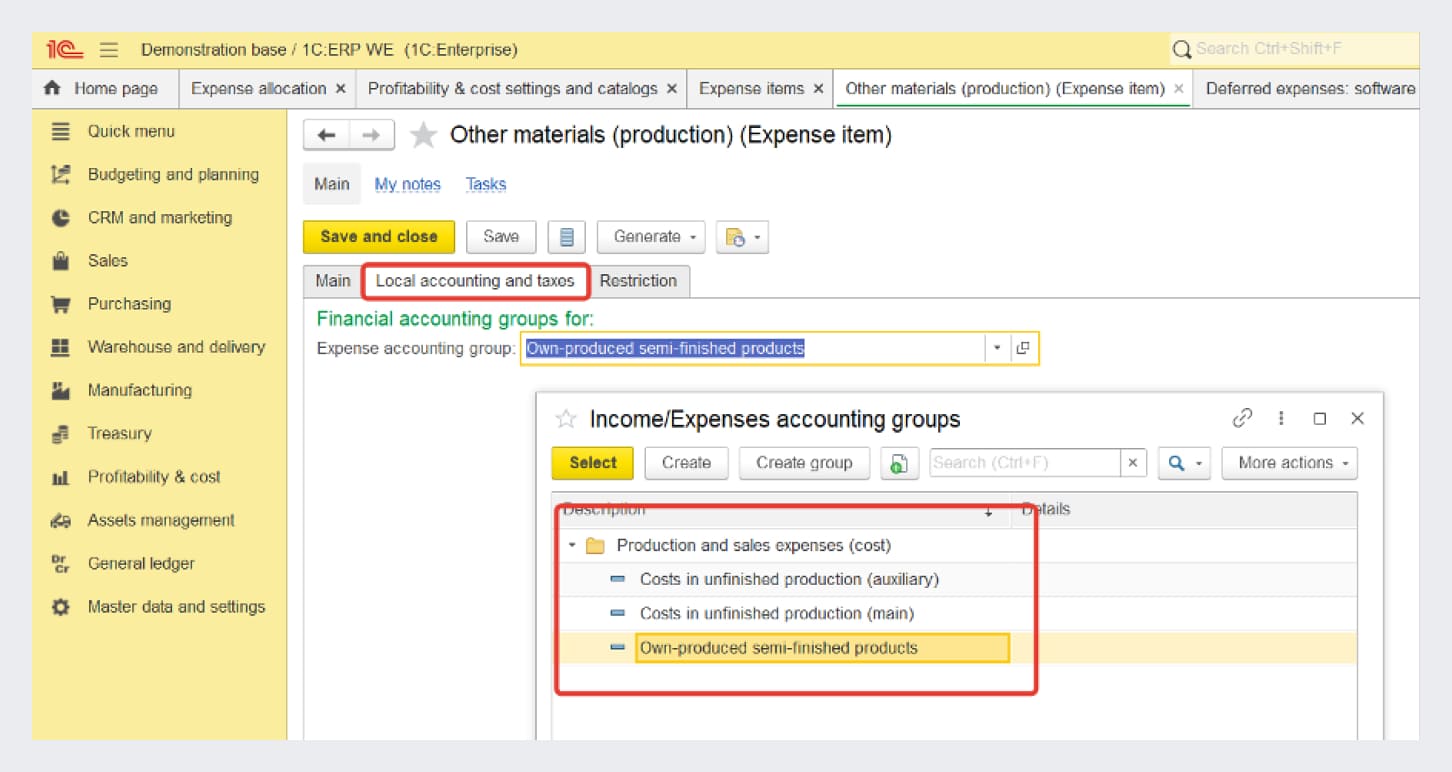

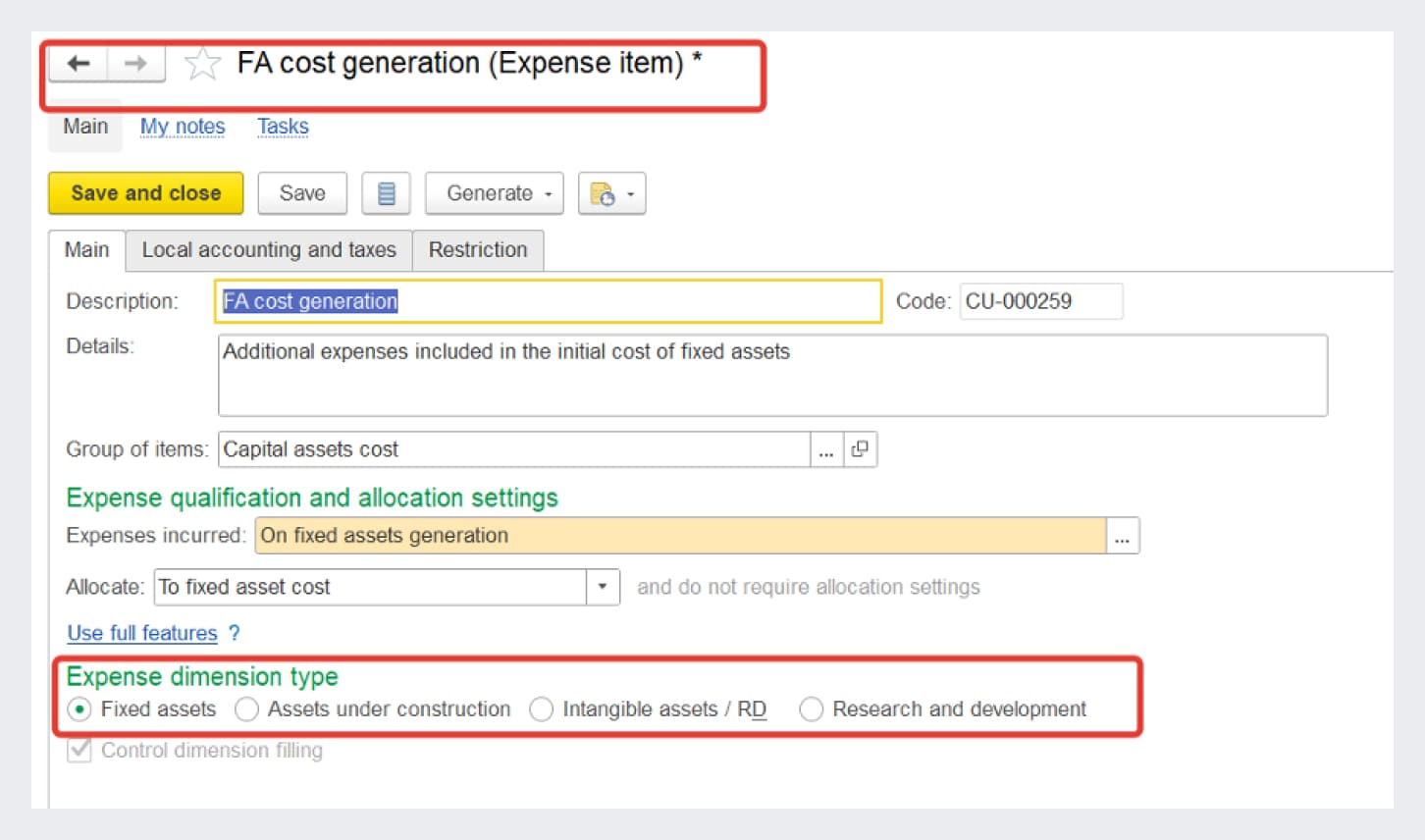

There are various options for allocating itemized expenses. They determine the economic sense of expenses recorded under a specific item: to inventory cost, to P&L items (expenses of the current period), to deferred expenses, to cost of goods sold, to production cost (direct), to production cost (overheads), to fixed asset cost, to cost centers.

Each itemized expense allocation option has its own allocation procedure.

Expenses are allocated automatically during month-end closing in the "Expense allocation to inventory costs" documents.

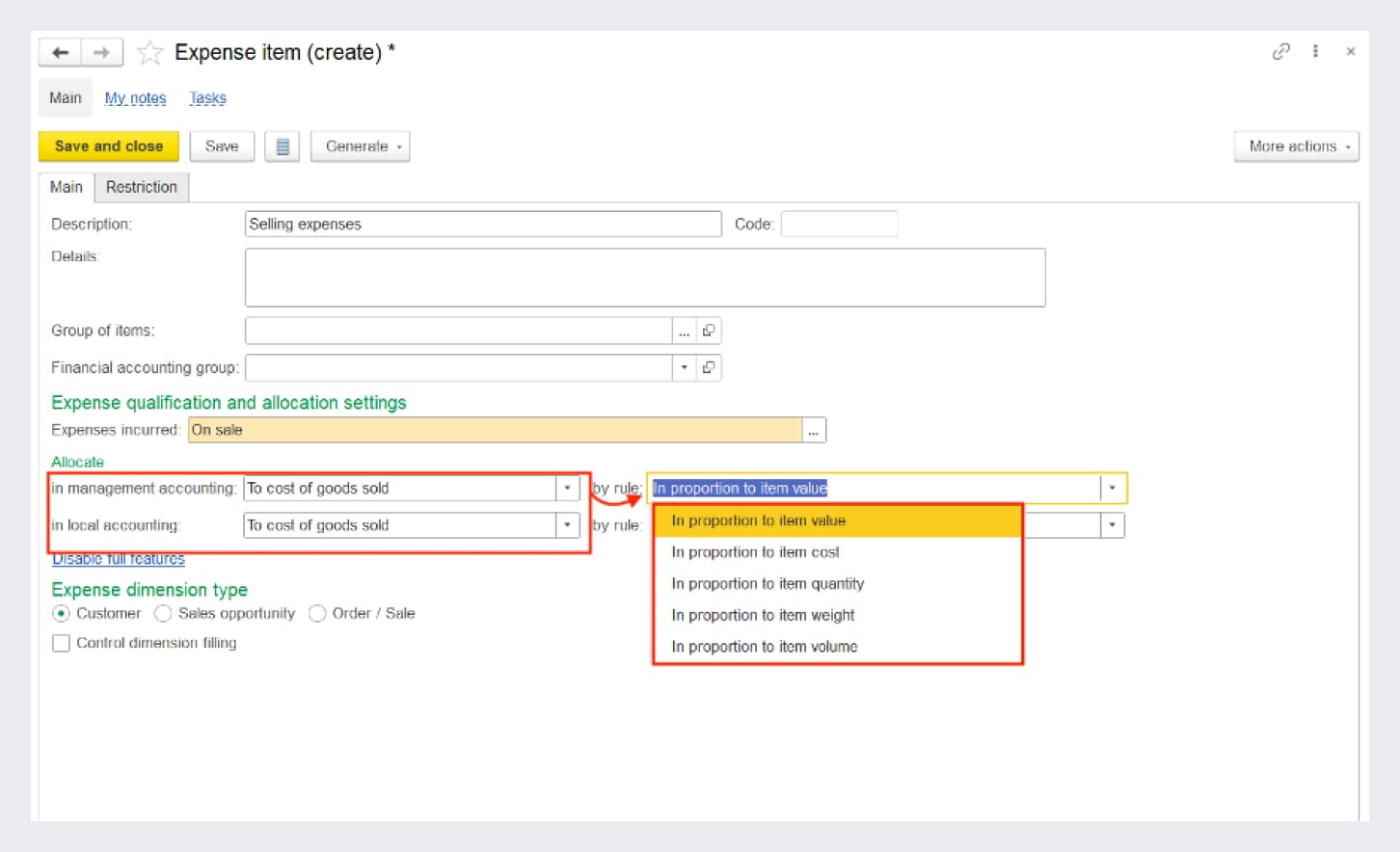

Setting up expense allocation to cost of goods sold

Expenses are allocated to cost of goods sold automatically during month-end closing.

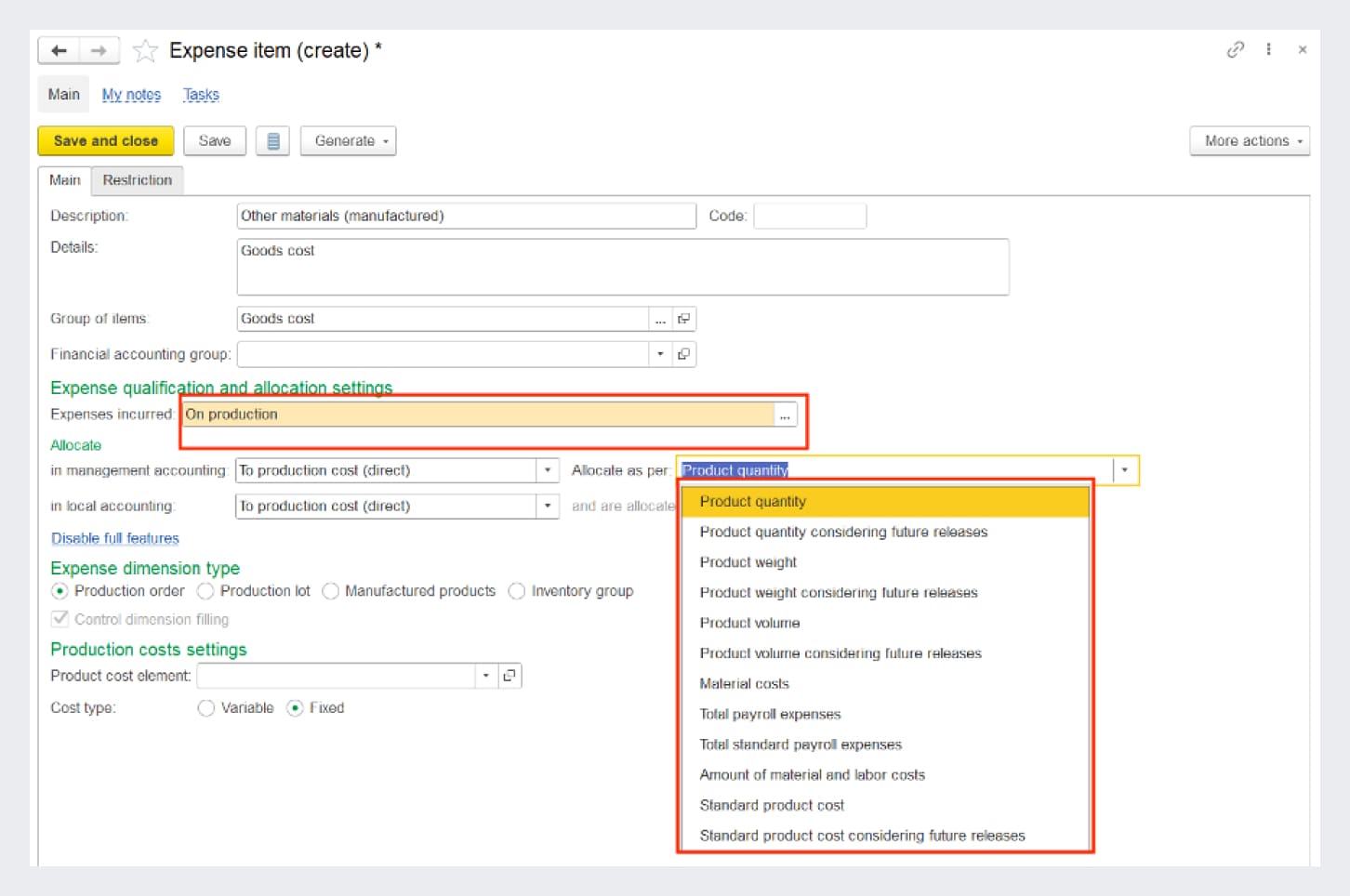

Setting up expense allocation to production cost (direct)

Expense items with the "To production cost (overheads)" allocation option are used to generate production costs allocated to the cost of manufactured products.

Itemized expenses can be allocated to production lots left in work-in-progress or reallocated to other items.

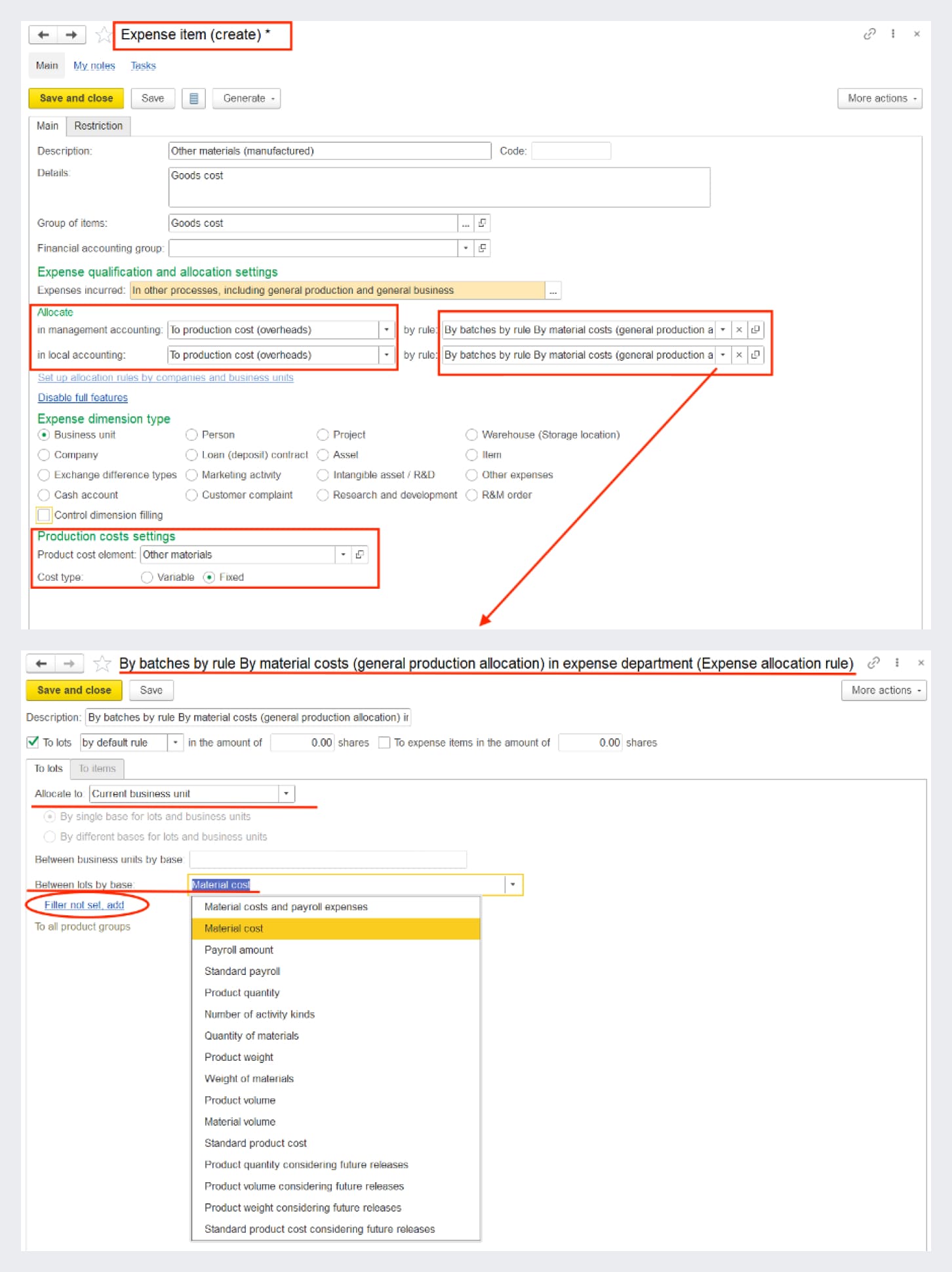

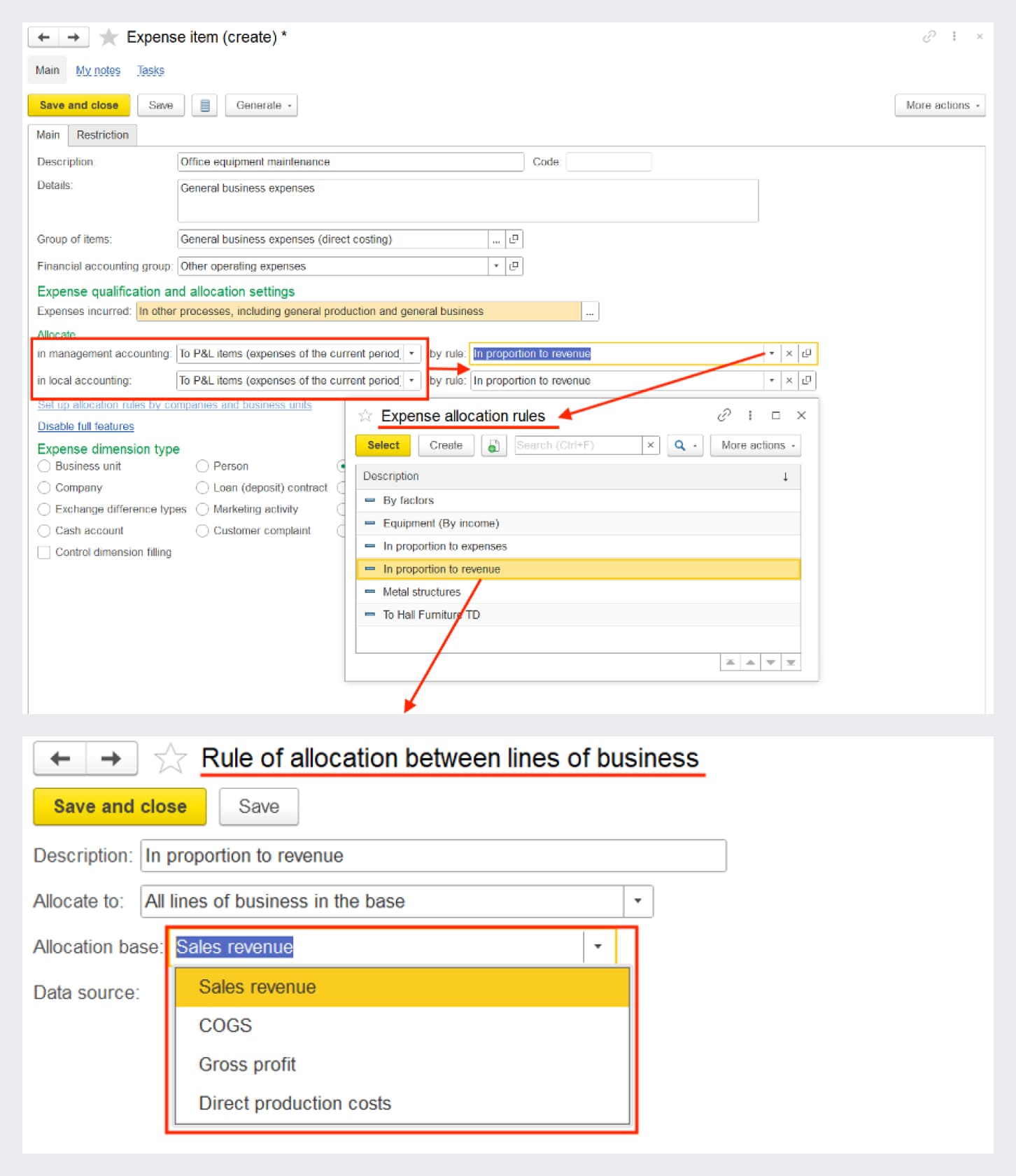

Costs are allocated according to a rule set up in advance and specified during allocation. You can create a complex allocation rule by simultaneously specifying allocation by lots and expense items and cost shares for each option.

The allocation rule determines business units to which expenses are allocated and the allocation base for business units and lots. In the allocation rule, you can set various filters for business units to which expenses must be allocated, and filters for expense allocation bases.

Setting up an expense item with the To production cost (overheads) allocation option and a distribution rule

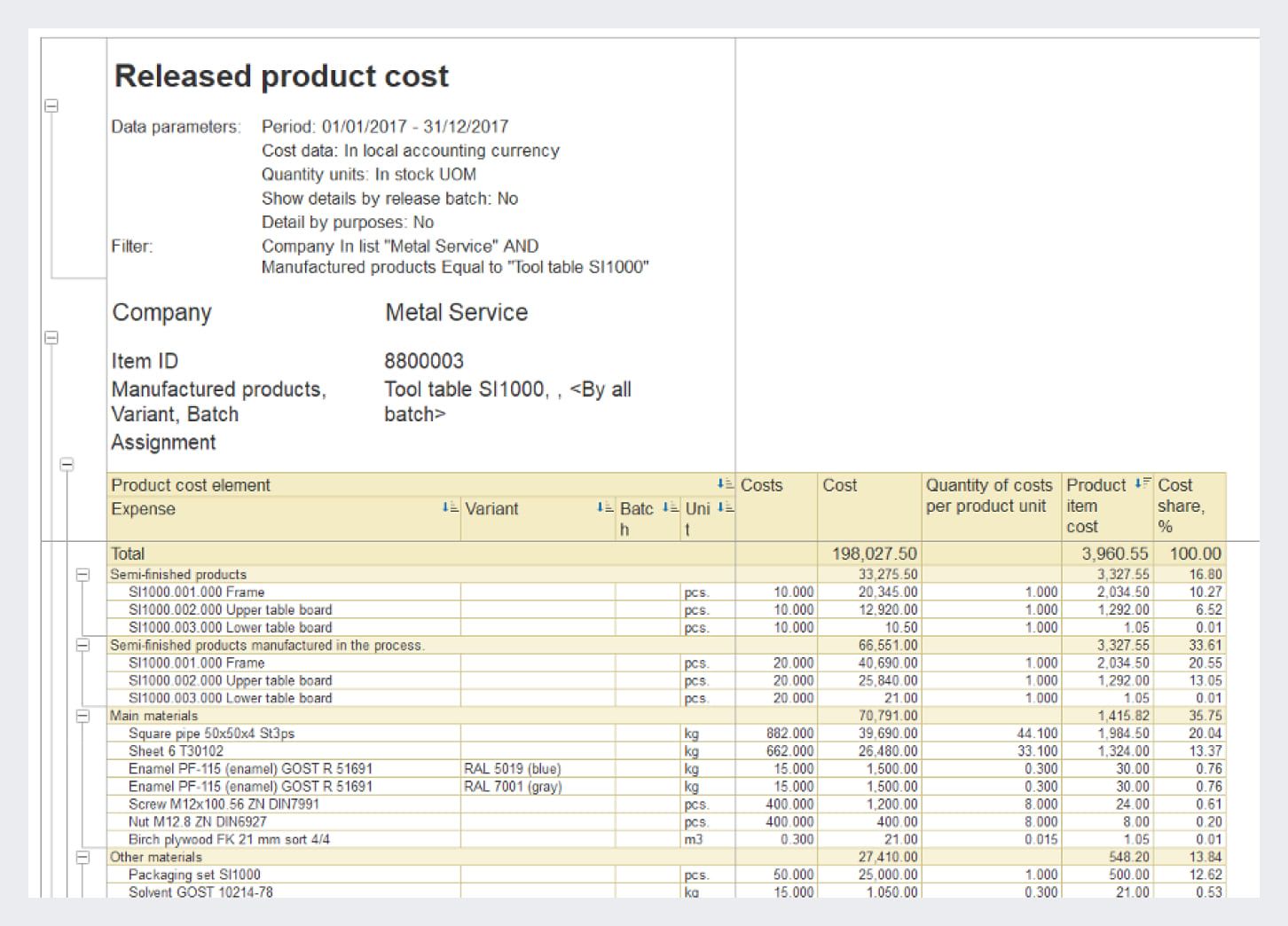

Itemized costs are included in the cost of manufactured products in accordance with the specified product cost element. Product cost elements are used to generate the cost of manufactured products and determine the type of costs included in the product cost.

To calculate income tax, production costs are classified as direct or indirect.

Setting up classification of expense items for calculating income tax

To allocate expenses to the production cost, use the "Expense allocation" document. In this document, you can allocate production costs assigned to a line of business to production lots with other lines of business.

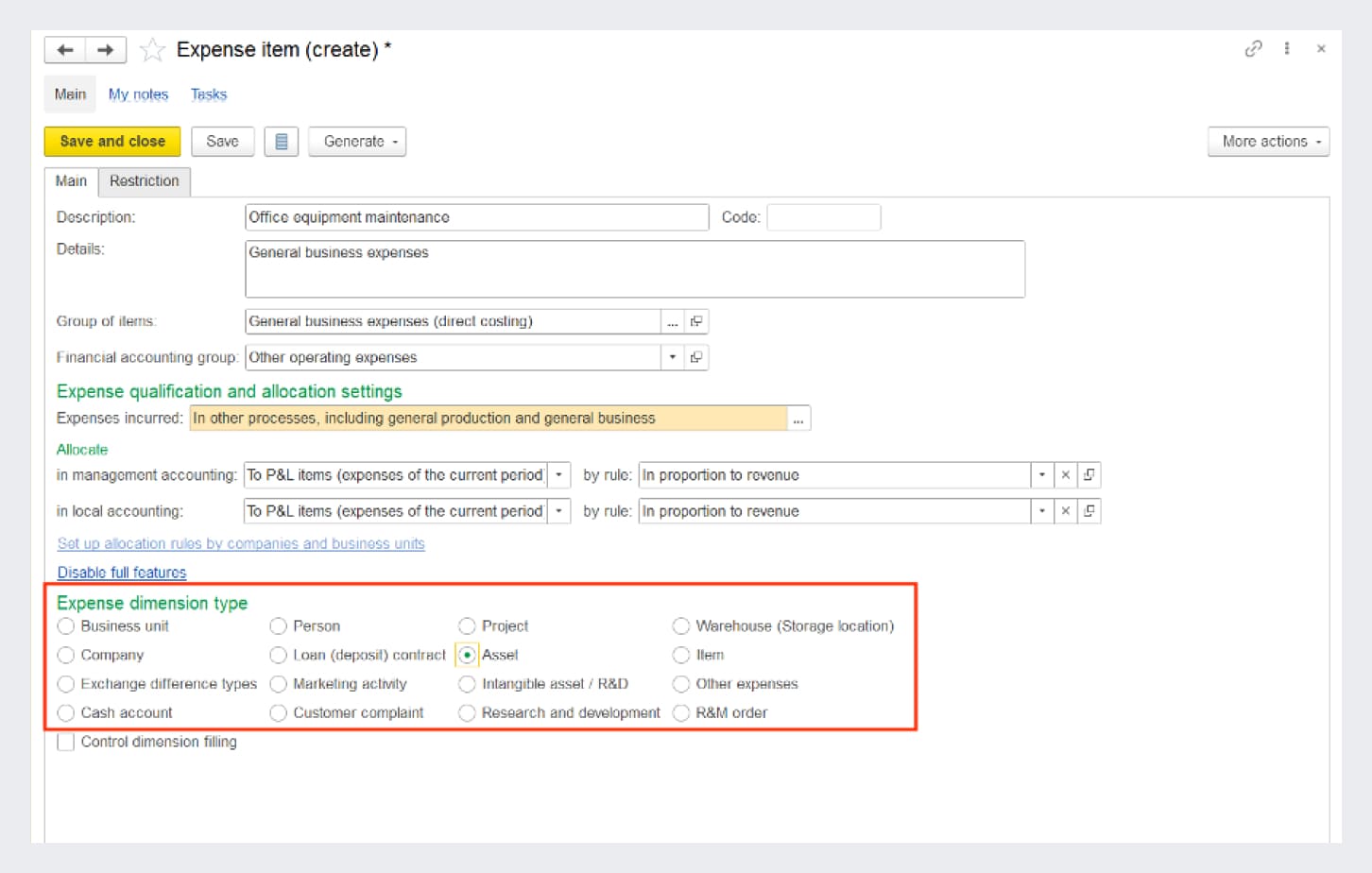

Setting up the expense dimension kind

You can simultaneously select a dimension kind and an allocation rule to analyze costs by two dimensions.

For example, specify the "Customer complaint" dimension kind and the set the "To line of business" allocation rule to "Warranty repair". This will generate the total cost of expenses for warranty repairs broken down by cost of eliminating all received complaints.

To allocate expenses by lines of business, use the "Expense allocation" document.

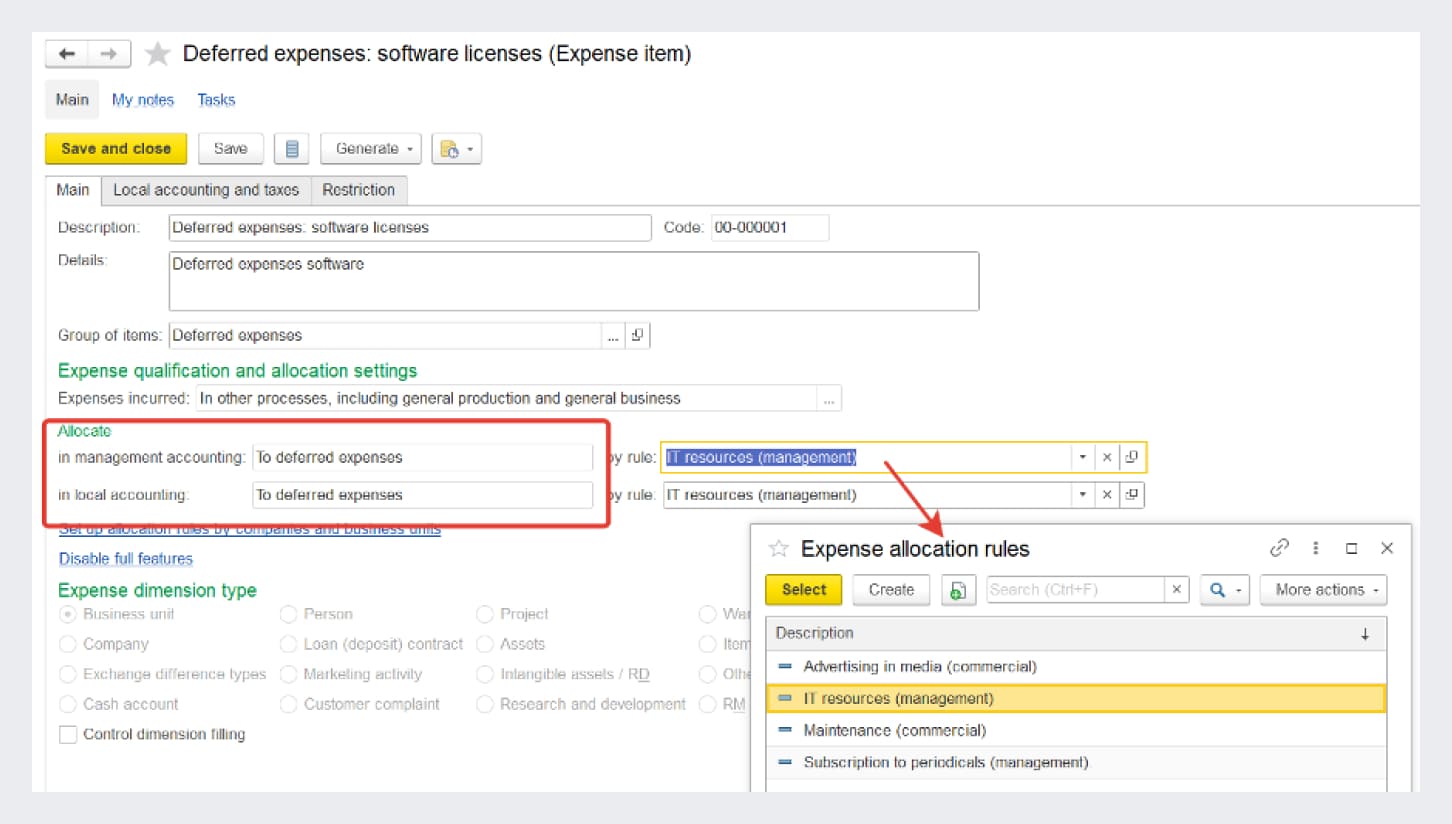

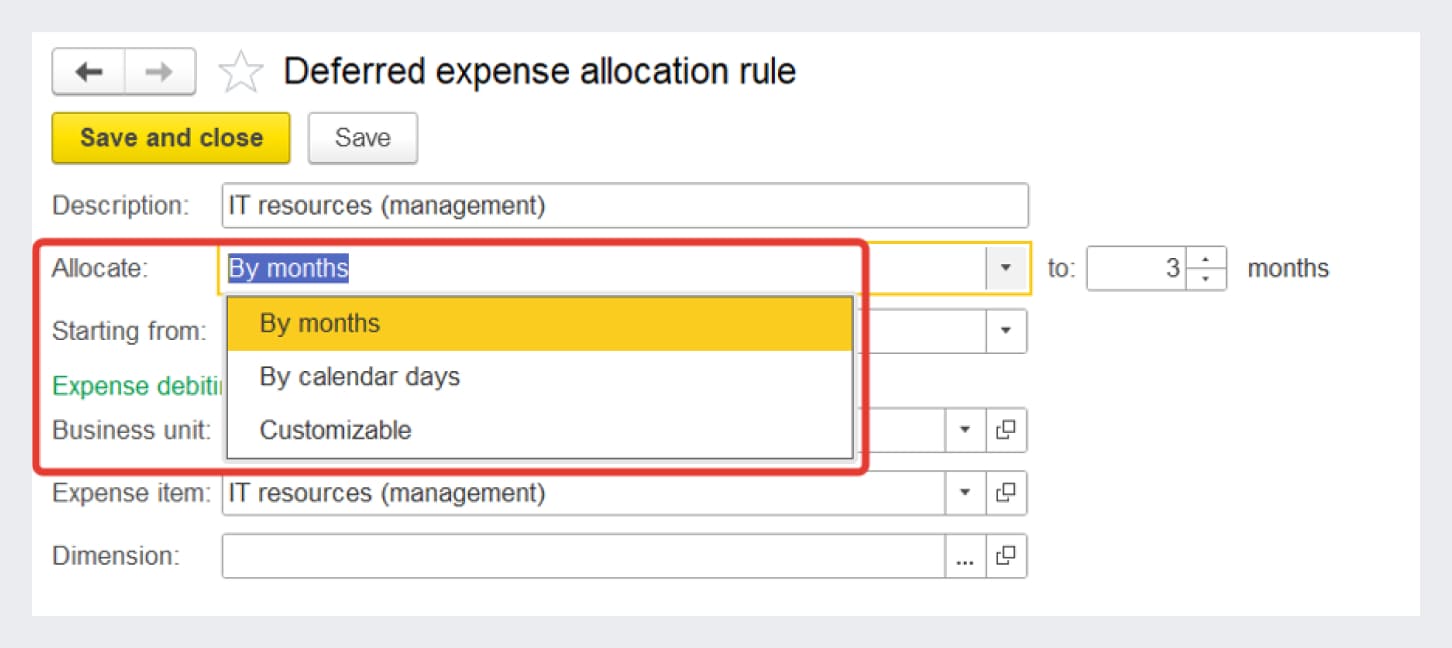

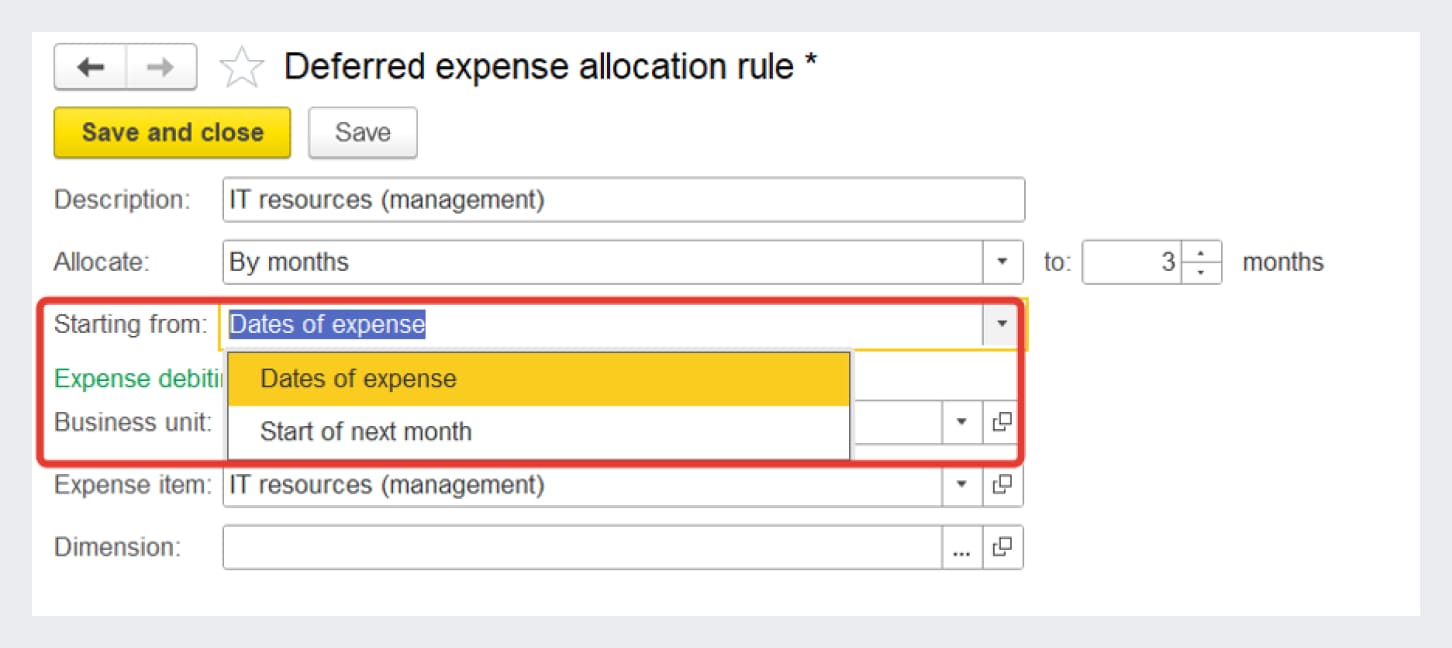

Deferred expense allocation rule

To allocate costs to deferred expenses, use the "Deferred expense allocation" document. The cost amount is allocated to the specified number of periods.

The "Deferred expense allocation" document is generated according to the rule selected for the expense item to allocate. You can specify allocation parameters of a specific expense directly in the "Deferred expense allocation" document.

Kinds of expense dimensions

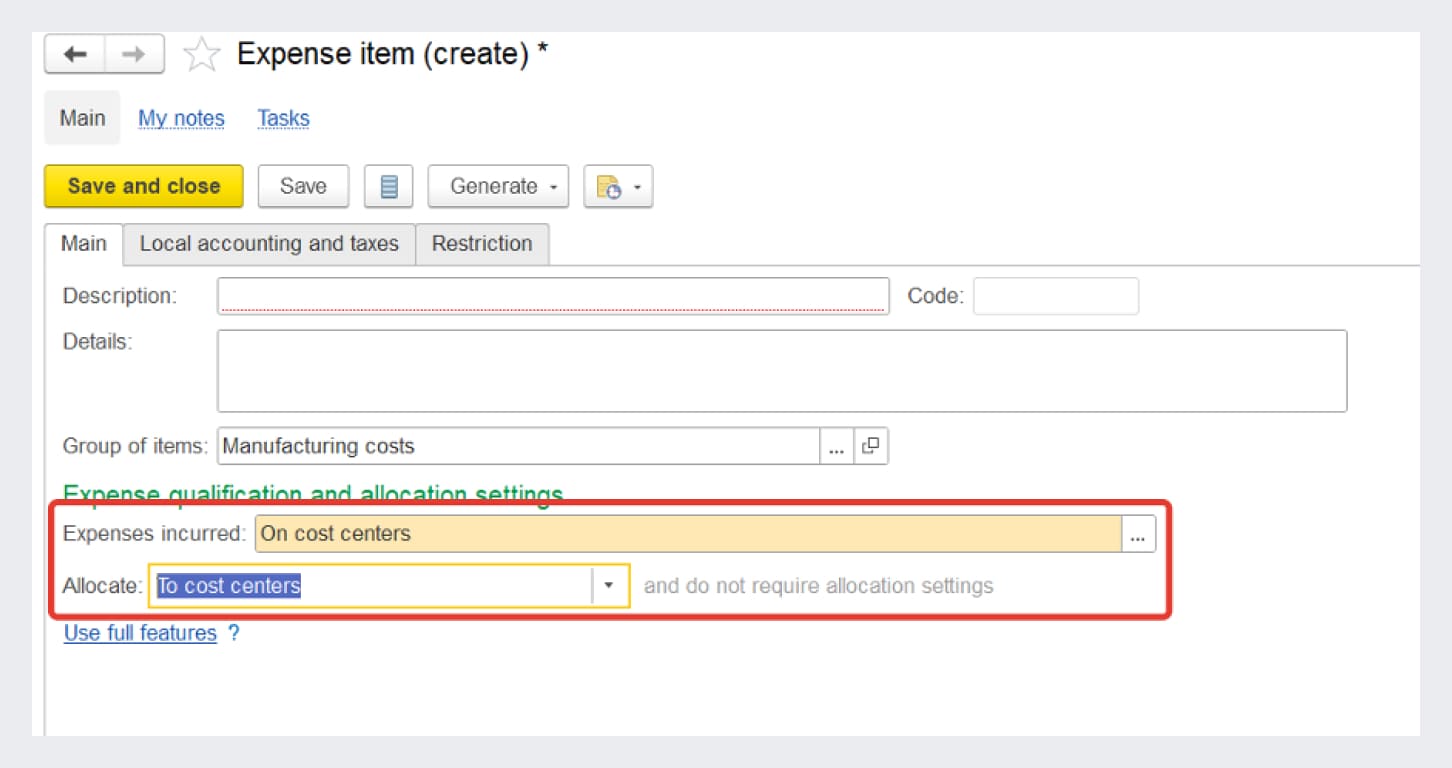

To organize accounting of itemized expenses using cost centers, the "Expense items" list card contains the "On cost centers" expense qualification option and the "To cost centers" allocation option.

Setting up expense item allocation to cost centers

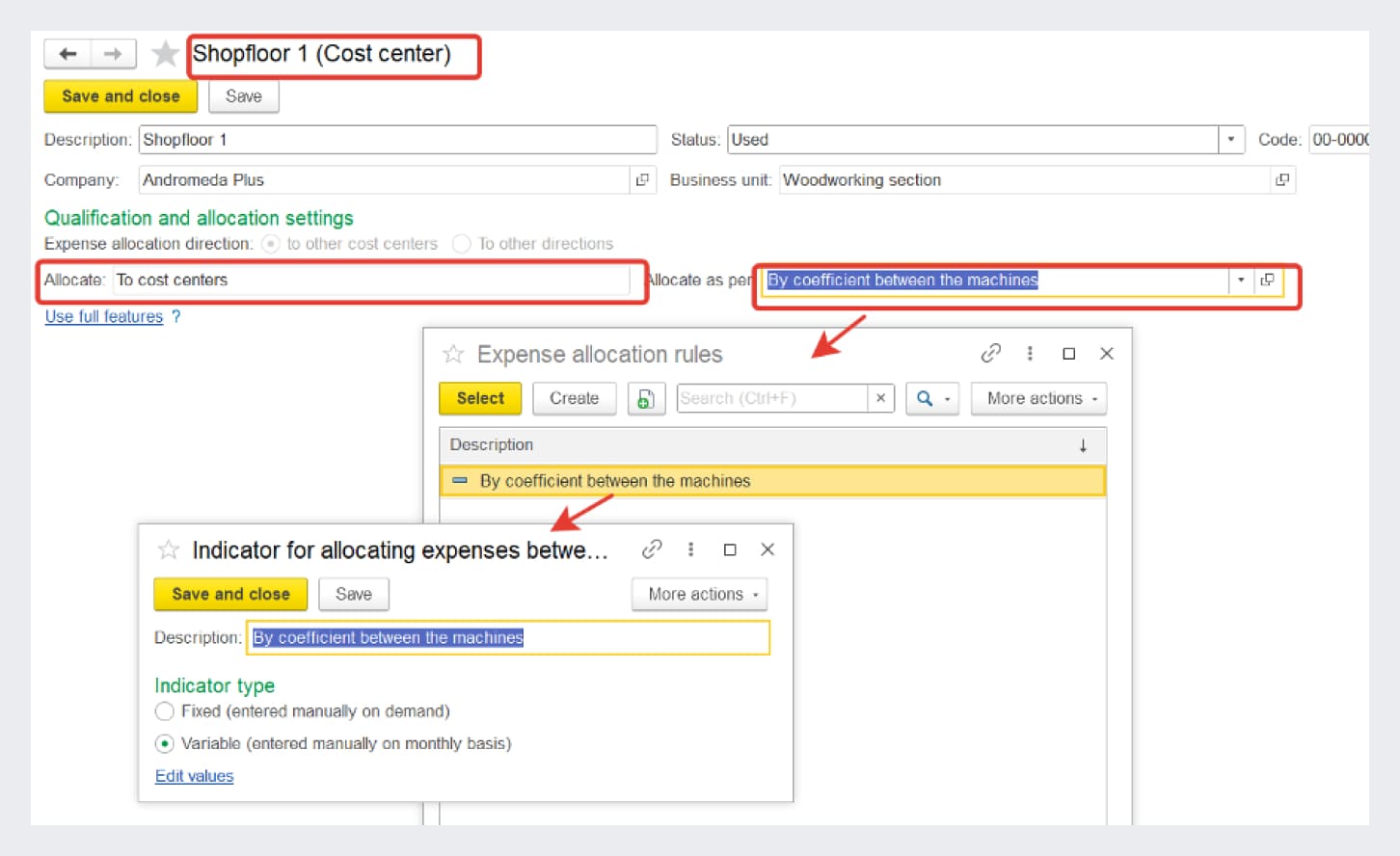

Cost centers are kept in the "Cost centers" catalog. You can set up the expense allocation procedure in the "Cost centers" list item card.

Setting up expense allocation indicators for cost centers in the cost centers card

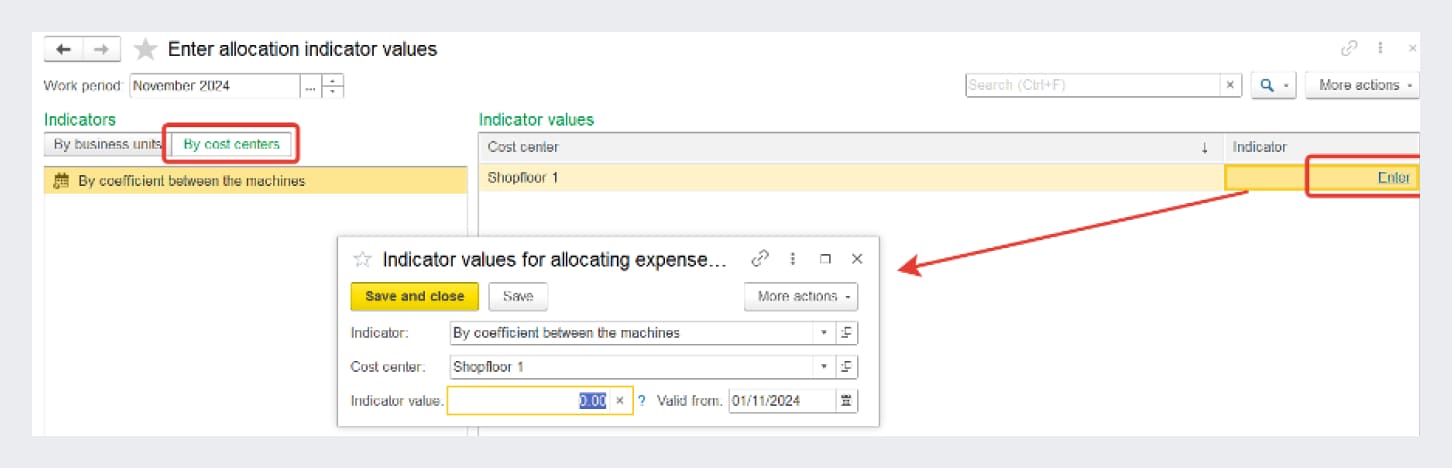

You can enter the values of expense allocation indicators by cost centers in the "Allocation rules and indicators" list item card (click "Edit values") and in the "Enter allocation indicator values"workplace.

Entering allocation indicators by cost centers

Allocation is performed automatically upon month-end closing.

Generation of Assets and Liabilities

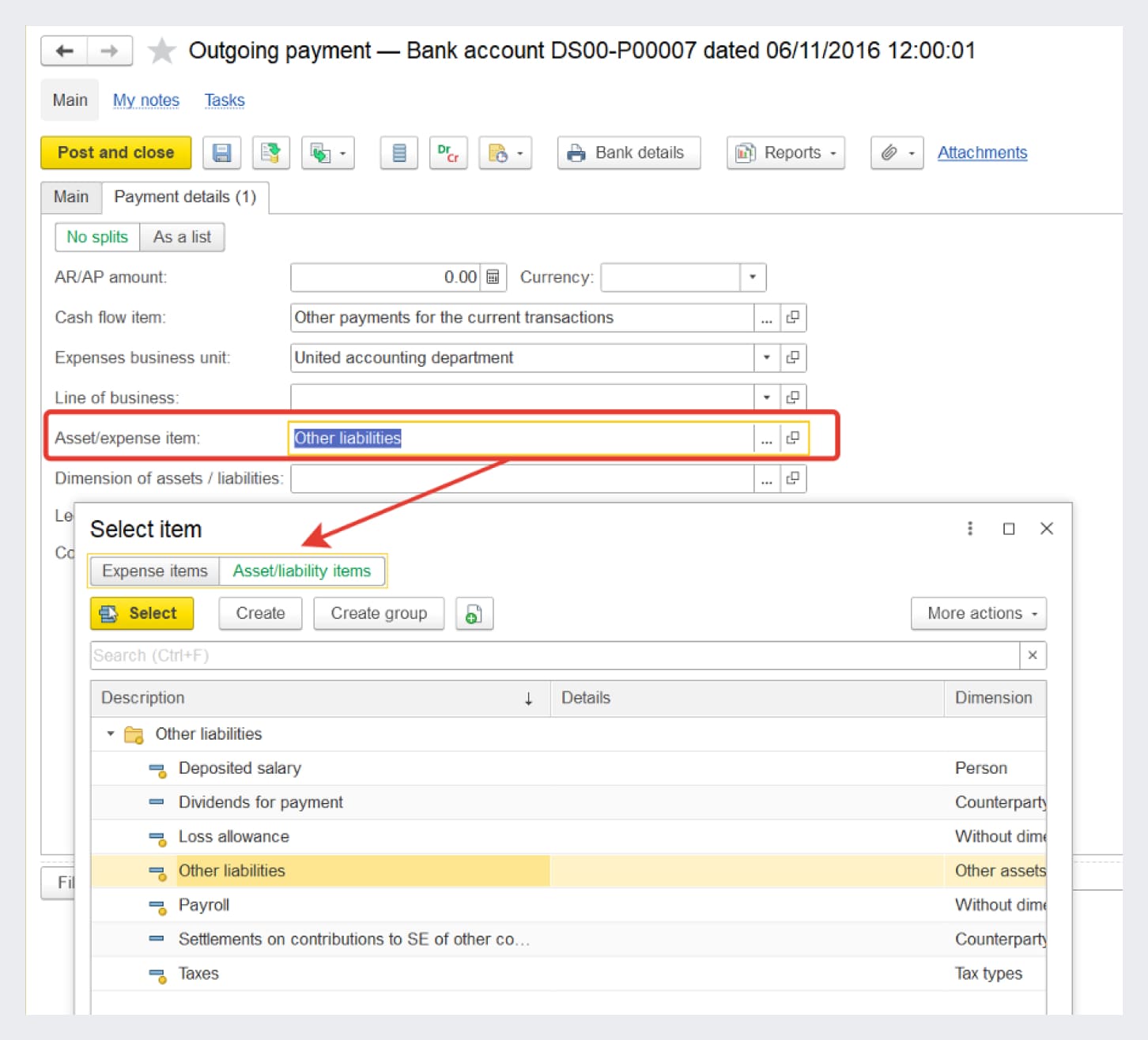

To record other transactions in the balance sheet, you can generate assets and liabilities. Assets and liabilities are generated during the following transactions: Tax payment, Other expenses, Other income.

To register other transactions, use standard documents where the asset/liability items are specified.

Example of liability generation

Product Release Cost

To calculate actual costs, use a universal workplace called "Month-end closing", where you can record closing transactions for all accounting periods.

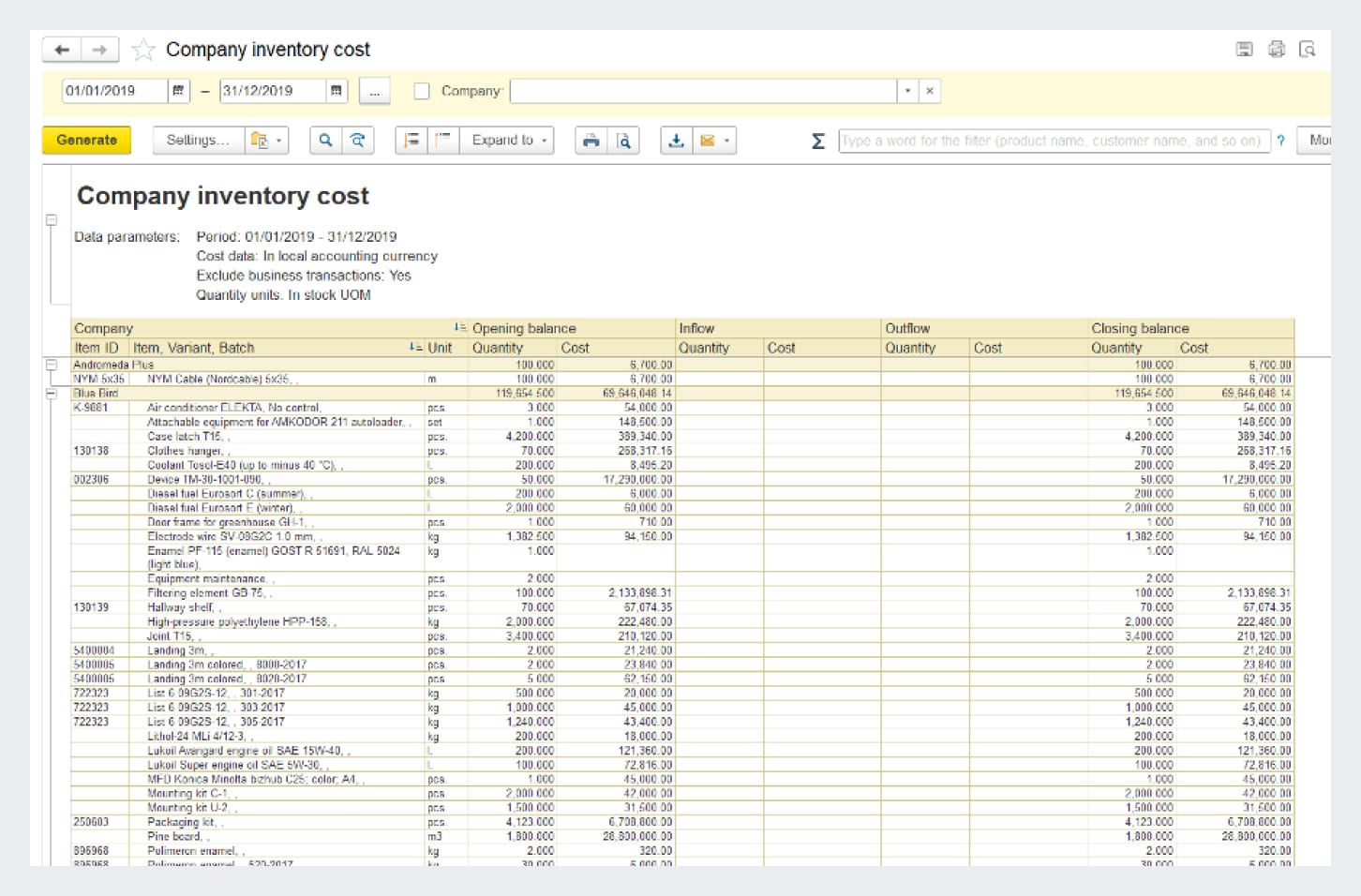

Use dedicated reports to analyze production costs, for example, "Company inventory cost" and "Released product cost".

Accounting of Other Expenses and Income

When you record any type of transaction, the amounts of management, local, and tax accounting are not required to fill in, which allows you to record transactions in one accounting type only.

Separate Profitability & Cost Accounting

In 1C:ERP, you can generate financial results from sales of goods and works separately by orders, sales opportunities, business units, managers, vendors, and groups of financial accounting of goods.

For each assignment object, you can generate a complete financial result (cost, revenue, profit, and profitability). You can see the financial result by assignment objects in various options of the "Gross profit" and "Income and expenses" reports.

Balance Sheet Statement

To assess the financial condition of an enterprise, use the "Balance sheet statement" report. It is a simplified version of the balance sheet.

The "Balance sheet statement" report allows you to manage assets and liabilities and control the use of financial resources. It includes data on financial accounting of goods, AR/AP with customers and vendors, balances of cash and non-cash funds, and other assets and liabilities.

The report can be generated both for the whole enterprise and for each individual company. Each section of the Balance sheet statement can be broken down by document with individual business transactions. Information about balance violations is displayed separately, which allows you to identify possible accounting errors.

Use the "Income and expenses" report for comprehensive analysis of all income and expenses of the enterprise by item.

Request Demo

Apply for a free personalized product demo and see the value of

1C:ERP yourself.